Vital Statistics:

| Last | Change | |

| S&P futures | 3,980 | 11.25 |

| Oil (WTI) | 71.93 | 0.89 |

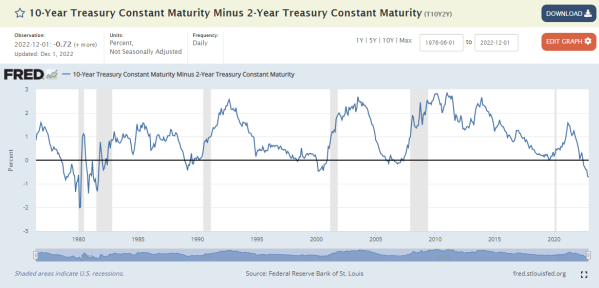

| 10 year government bond yield | 3.53% | |

| 30 year fixed rate mortgage | 6.35% |

Stocks are higher this morning as we head into Fed Week. Bonds and MBS are flat.

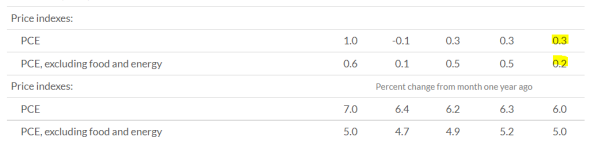

The week ahead will have two major reports, with the Consumer Price Index tomorrow, and the FOMC meeting on Wednesday.

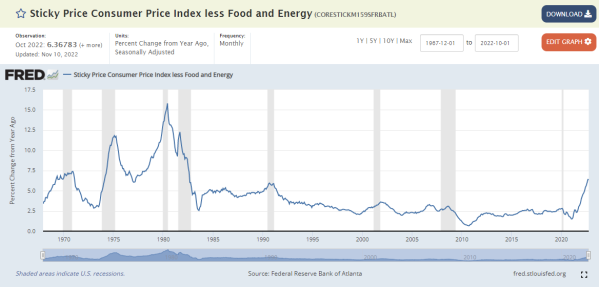

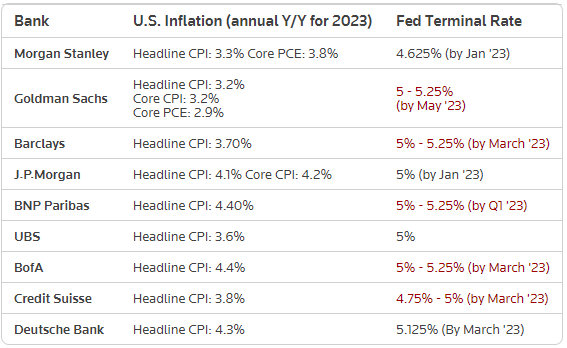

The Fed funds futures see a 77% chance of a 50 basis point hike and a 23% chance of a 75 basis point hike. Given some of the language from different Fed speakers, we could see a pretty wide range for the 2023 Fed Funds forecast in the dot plot.

Purchase locks fell 22% in November, according to Black Knight. Overall lock volumes fell 21.5% and are down 68.5% compared to a year ago. A combination of the normal seasonal slowdown and affordability issues are making a perfect storm for mortgage bankers. “Mortgage rates pulled back slightly in November based on what the market perceived as good inflation news,” said Scott Happ, president of Optimal Blue, a division of Black Knight. “The spread between mortgage rates and the 10-year Treasury yield narrowed by 13 basis points during the month to 283 basis points in a sign that investors and lenders may be seeking to accelerate the impact of falling rates. But, despite the improvement in rates, lock activity remained subdued.”

Homebuyer demand ticked up slightly as lower rates are beginning to get some potential buyers interested. “This week has been relatively calm and quiet as we approach the end of one of the most volatile years in housing history,” said Redfin Deputy Chief Economist Taylor Marr. “But it’s not over yet. Next Tuesday’s inflation report is the 500-pound gorilla in the room, and the Fed’s press conference the next day will bring us much more clarity on how soon and how quickly we can expect mortgage rates to come down in the new year. Since we expect only a small decline in prices next year, mortgage rates will dictate housing affordability, and as a result, demand and sales, in 2023. If rates continue declining, more buyers may wade back into the market, as they’ll have lower monthly payments.”

Good read from CNBC reporter Ron Insana on what ails the economy. In his opinion, the US economy suffers from a shortages all over the place, particularly in the labor market. The Fed’s prescription is to increase the unemployment rate to 5% in order to bring the supply and demand imbalance more in line. Will that make the economy stronger? The answer is probably no. He recommends that we ease immigration rules to let in more people to fill the supply gap in the labor market.

It is an interesting prescription. The US has encouraged college at the expense of skilled labor for the past few decades, and now it seems we have a glut of over-educated and indebted people with few tangible skills, and a deficit of people who can weld, wire an electrical panel or swing a hammer. Increasing immigration will do wonders for the latter, but I don’t know what it will do for the former.