Vital Statistics:

|

Last |

Change |

| S&P futures |

2874 |

24.5 |

| Oil (WTI) |

54.62 |

-0.14 |

| 10 year government bond yield |

|

1.55% |

| 30 year fixed rate mortgage |

|

3.78% |

Stocks are higher on no real news this morning. There is a risk-on feel to the tape after a tumultuous week. Bonds and MBS are down.

Housing starts disappointed (again!) coming in at 1.19 million, lower than the 1.26MM street estimate. This is down 4% on a MOM basis, and up about 0.6% on a YOY basis. On the bright side, building permits surprised to the upside, coming in at 1.34 million versus the 1.27 million street estimate. Still, new home construction remains depressed due to labor shortages and lack of buildable lots.

Despite these issues, homebuilders remain optimistic. The NAHB / Wells Fargo Builder Sentiment Index rose in August to 66. Current sales conditions improved, while expectations for the next six months moderated. “While 30-year mortgage rates have dropped from 4.1 percent down to 3.6 percent during the past four months, we have not seen an equivalent higher pace of building activity because the rate declines occurred due to economic uncertainty stemming largely from growing trade concerns,” said NAHB Chief Economist Robert Dietz. “Although affordability headwinds remain a challenge, demand is good and growing at lower price points and for smaller homes.” Interesting about the tariff issue – building materials prices are down quite substantially. If tariffs were really that big of a deal, you would expect to see shortages and increases. We aren’t.

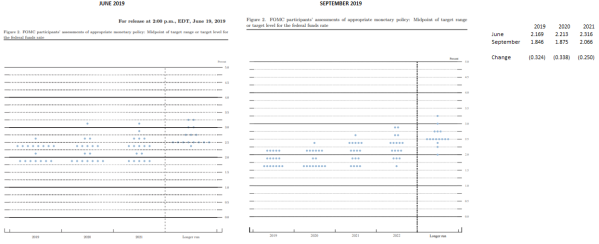

Given all the chatter about the yield curve and a possible recession, it is worthwhile to step back and take a look at the facts on the ground. The business press is awash with stories about the yield curve and how it is possibly signalling a recession. Quick explanation: the yield curve shows interest rates along the spread of maturities, and short term rates are usually lower than long term rates. However, we are flirting with a situation where long term rates are lower than short term rates. That is a yield curve inversion, and historically a yield curve inversion has been a decent (but not perfect) predictor of an imminent recession. The reason for this is that it implies that businesses are taking less risk, which means they must see something wrong in the economy.

The problem with the inverted yield curve model is that it gives off a lot of false positives – an old market saw is that an inverted yield curve has predicted “15 of the last 10 recessions.” Many times an inverted yield curve is the result of technical issues in the bond markets, which are temporary and don’t really spill through to the overall economy. This current period is probably one of those cases, and the technical issue is central bank behavior. The Fed, ECB, Bank of Japan have been pushing down long term rates in order to stimulate the economy for years, and now we have negative interest rates in much of the world. Negative interest rates in Germany and Japan (two huge bond markets) are pulling down US bond yields as overseas investors sell government debt that pays less than nothing (German Bunds and Japanese Government bonds) to buy government debt that does pay something (US Treasuries).

The business press is emphasizing the Trump / tariff / recession angle here because (1) it is a much simpler story to tell, (2) the partisans get to blame it on Trump, and (3) many strategists reluctant to stick their necks out and discuss the implications of negative rates worldwide – this is a completely new phenomenon and quite simply people don’t know. We have a bubble in sovereign debt that has been engineered by global central banks – and unlike stock and real estate bubbles, we don’t have any historically similar periods to review. We know that bubbles end eventually, but when and how this resolves is anyone’s guess.

That said, what is the current economic state of play? Europe is doing its same-old Euro-sclerosis thing, which it has been doing for decades. Germany had a slightly negative GDP quarter and most of the Eurozone is slowing down in sympathy. Japan has been in the throes of a sclerotic economy since the New Kids on the Block ruled the charts. China is also tempering its growth. On the other side of the coin, the US has the lowest unemployment rate in 50 years, initial jobless claims are the lowest since we had a military draft, wages are rising, inflation is under control, and the consumer is increasing spending. This simply is not a recipe for a recession. And to take this a step further, tariff income has been about $60 billion since they have been implemented. In the context of a $21 trillion economy, this is insignificant – about 1/3 of 1%. It is a humorous state of affairs with partisan talking heads accusing Trump of destroying the economy over small-beer tariffs, while Trump accuses partisan journalists of sabotaging the economy with negative stories – as if the press had the power to do that.

Here is the big picture: The US economy has been strong enough to withstand a tightening cycle from the Fed, and has had 2.6% GDP growth in the immediate aftermath of a tightening cycle. Inflation is low, and is probably going to go lower as Europe and China begin exporting deflation to the US. Oh, and by the way the Fed is now cutting interest rates, which is the equivalent of giving a can of Red Bull to your kid at 9:00 pm on Halloween night. Don’t buy the recession narrative. None of the required pieces are in place.