Vital Statistics:

| Last | Change | |

| S&P futures | 4,440 | -29.2 |

| Oil (WTI) | 91.35 | -2.23 |

| 10 year government bond yield | 1.97% | |

| 30 year fixed rate mortgage | 4.17% |

Stocks are lower this morning on continued Ukraine fears. Bonds and MBS are flat.

The Fed released the minutes from the January FOMC meeting yesterday. The Fed will be taking it meeting by meeting, and did allow for the possibility that they might have to be more aggressive than the December dot plot indicated, which is a nod to the fact that the Fed Funds futures and the December dot plot have a pretty big difference between forecasts.

In their discussion of the outlook for monetary policy, many participants noted the influence on financial conditions of the Committee’s recent communications and viewed these communications as helpful in shifting private-sector expectations regarding the policy outlook into better alignment with the Committee’s assessment of appropriate policy. Participants continued to stress that maintaining flexibility to implement appropriate policy adjustments on the basis of risk-management considerations should be a guiding principle in conducting policy in the current highly uncertain environment. Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate. Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation. A few participants remarked that this risk could be mitigated through clear and effective communication of the Committee’s assessments of the economic outlook, the risks around the outlook, and the appropriate path for monetary policy.

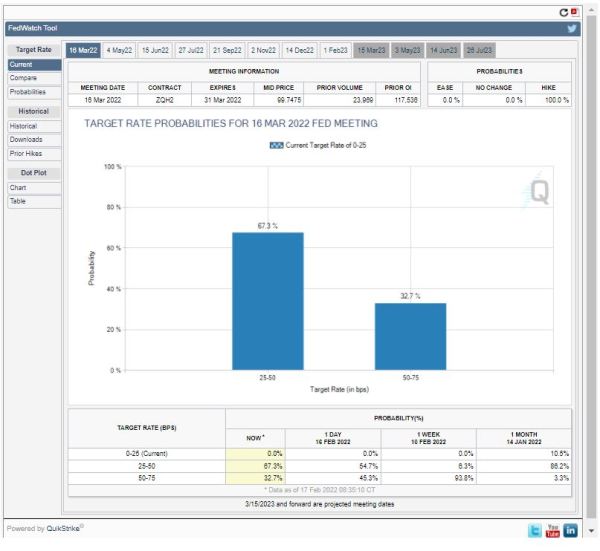

The Fed Funds futures moved ever-so-slightly less hawkish on the news, with the March futures now predicting a roughly 2/3 chance of a 25% hike and a 1/3 chance of a 50 basis point hike compared to roughly a toss-up the day before.

Bottom line, the Fed is looking at the Fed Funds futures and it realizes the market is much more hawkish than they were in December. They are still of the opinion the inflation will moderate as supply chain issues work themselves out, however they are ready to act as necessary if that turns out to not be the case. They are concerned that credit will tighten as they raise rates, but they hope that they can avoid this through clear communication.

Housing starts disappointed yet again, coming in at 1.64 million versus the 1.71 that was expected. Building Permits came in at 1.9 million, which was above expectations, so perhaps this will change in the future. Materials aka “sticks and bricks” remain expensive and that is undoubtedly affecting things. Lumber continues its upward trend:

One of the most precious commodities these days is apparently garage doors. “It used to take us 20 weeks to build a house,” said Adrian Foley, the president and C.E.O. of the Brookfield Properties development group, which develops thousands of single-family homes annually in North America. “And now it takes us 20 weeks to get a set of garage doors.”

Shortages of skilled labor are an issue as well. The US has a glut of humorless BAs, and not enough welders or electricians.

In other economic news, unemployment claim ticked up to 248k last week. This well above pre-pandemic levels, which were averaging around 220k. One data point doesn’t make a trend, but we might be seeing signs the labor market is cooling.