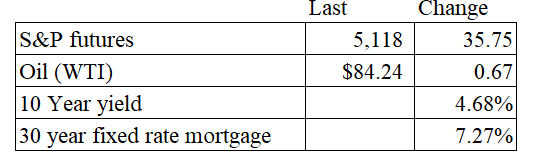

Vital Statistics:

Stocks are higher this morning after good earnings from Google and Microsoft. Bonds are up.

Personal incomes rose 0.5% MOM in March, while personal consumption rose 0.8%. Spending rose 0.8%, driven by increases in healthcare and housing. Again, I point to the vibecession here – high consumer spending is usually associated with economic booms, however when the increased spending is driven by non-discretionary items, it doesn’t feel like a boom. Nobody gets a recreational root canal.

The PCE Price Index – the Fed’s preferred measure of inflation came in more or less as expected. The monthly numbers were spot-on with estimates, while the annual numbers were slightly higher than expected. Given the recent increase in rates, the slight miss didn’t move yields higher – in fact, they are falling this morning.

The core PCE Price Index continues to work its way down, however you can see the stall early this year.

Pending Home Sales rose 3.4% in March, according to NAR. “March’s Pending Home Sales Index – at 78.2 – marks the best performance in a year, but it still remains in a fairly narrow range over the last 12 months without a measurable breakout,” said NAR Chief Economist Lawrence Yun. “Meaningful gains will only occur with declining mortgage rates and rising inventory. Home sales have lingered at 30-year lows, and since 70 million more Americans live in the country now compared to three decades ago, it’s inevitable that sales will rise in coming years,” explained Yun. “Inventory will grow steadily from more home construction, and various life-changing events will require people to trade up, trade down or move to another location.”